Scenario

A company sells goods to a customer on credit. Here’s the transaction and how it affects the accounts:

Transaction Details:

- Date: 2023-07-15

- Customer: ABC Corp

- Sales Invoice Amount: BDT 15,000

- Cost of Goods Sold (COGS): BDT 9,000

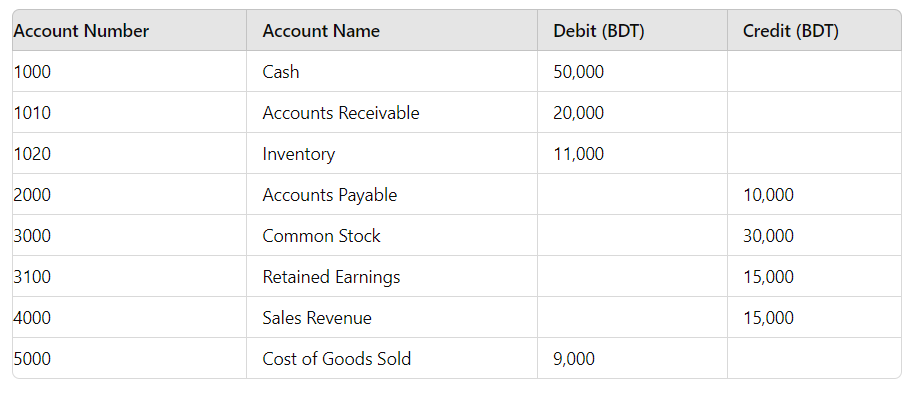

Chart of Accounts Before Sales Invoice Entry

Here’s a simplified version of the relevant chart of accounts before the sales invoice is entered:

Journal Entries for Sales Invoice

When the sales invoice is entered, two journal entries are recorded:

Record the Sale:

- Debit: Accounts Receivable for BDT 15,000

- Credit: Sales Revenue for BDT 15,000

Record the Cost of Goods Sold:

- Debit: Cost of Goods Sold for BDT 9,000

- Credit: Inventory for BDT 9,000

Chart of Accounts After Sales Invoice Entry

After recording the sales invoice, the chart of accounts reflects these changes:

Explanation

- Accounts Receivable (1010): Increased by BDT 15,000, reflecting the amount the customer owes for the sale.

- Sales Revenue (4000): Increased by BDT 15,000, reflecting the income from the sale.

- Inventory (1020): Decreased by BDT 9,000, reflecting the cost of the goods that were sold.

- Cost of Goods Sold (5000): Increased by BDT 9,000, reflecting the expense associated with the goods sold.

Effects on Financial Statements

Balance Sheet:

- Assets: Accounts Receivable increases, and Inventory decreases, resulting in no net change in total assets.

- Equity: No immediate effect on equity, but it will be affected by net income when revenue and expenses are closed to retained earnings.

Income Statement:

- Revenue: Sales Revenue increases, boosting total income.

- Expenses: Cost of Goods Sold increases, reducing net income.

2. how a sales return entry affects the chart of accounts

Scenario

A customer returns goods that were previously sold. The return affects the revenue, accounts receivable, and inventory accounts.

Transaction Details:

- Date: 2023-08-10

- Customer: ABC Ltd

- Sales Return Amount: BDT 5,000

- Original Sale Invoice: BDT 20,000

- Goods Returned to Inventory: BDT 3,000

Chart of Accounts Before Sales Return Entry

Here’s a simplified version of the relevant chart of accounts before the sales return entry:

Journal Entry for Sales Return

When the sales return is processed, the following journal entries are recorded:

Reverse the Sales Revenue:

- Debit: Sales Returns and Allowances for BDT 5,000

- Credit: Accounts Receivable for BDT 5,000

Return Goods to Inventory:

- Debit: Inventory for BDT 3,000

- Credit: Cost of Goods Sold for BDT 3,000

Chart of Accounts After Sales Return Entry

After recording the sales return, the chart of accounts reflects these changes:

Explanation

- Accounts Receivable (1010): Decreased by BDT 5,000, reflecting the reduction in the amount owed by the customer due to the return.

- Inventory (1020): Increased by BDT 3,000, reflecting the addition of returned goods back into inventory.

- Sales Revenue (4000): Decreased by BDT 5,000, reflecting the reversal of revenue due to the return.

- Cost of Goods Sold (5000): Decreased by BDT 3,000, reflecting the reduction in cost due to returned goods.

Effects on Financial Statements

Balance Sheet:

- Assets: Inventory increases, and Accounts Receivable decreases.

- Liabilities: No change, as this transaction primarily affects assets and revenue accounts.

Income Statement:

- Revenue: Sales Revenue decreases, reducing net income.

- Expenses: Cost of Goods Sold decreases, which offsets the reduction in revenue to some extent.

Summary

Recording a sales return in an ERP system involves adjusting both the revenue and inventory accounts. This process ensures accurate financial records by reversing the impact of the original sale, updating the company's revenue, inventory levels, and accounts receivable. This entry is essential for maintaining accurate financial statements and understanding the impact of returns on business performance.

3. how a supplier payment entry affects the chart of accounts

Let's walk through how a supplier payment entry affects the chart of accounts in an ERP system. We will consider a scenario where a company makes a payment to a supplier for a previously recorded purchase.

Scenario

A company pays a supplier for raw materials previously purchased on credit. Here’s how the transaction affects the accounts:

Transaction Details:

- Date: 2023-08-05

- Supplier: XYZ Corp

- Payment Amount: BDT 10,000

- Payment Method: Cash

- Original Purchase Invoice: BDT 12,000 (BDT 10,000 remains unpaid)

Chart of Accounts Before Supplier Payment Entry

Here’s a simplified version of the relevant chart of accounts before the supplier payment entry:

| Account Number | Account Name | Debit (BDT) | Credit (BDT) |

|---|---|---|---|

| 1000 | Cash | 33,500 | |

| 1020 | Inventory - Raw Materials | 17,000 | |

| 2000 | Accounts Payable | 22,000 | |

| 2100 | Long-term Debt | 50,000 | |

| 3000 | Common Stock | 30,000 | |

| 3100 | Retained Earnings | 20,000 | |

| 6000 | Salaries and Wages Expense | 32,000 | |

| 2010 | Provident Fund Payable | 4,000 | |

| 2020 | Payroll Taxes Payable | 3,000 |

Journal Entry for Supplier Payment

When the payment is made to the supplier, the following journal entry is recorded:

- Record the Supplier Payment:

- Debit: Accounts Payable for BDT 10,000

- Credit: Cash for BDT 10,000

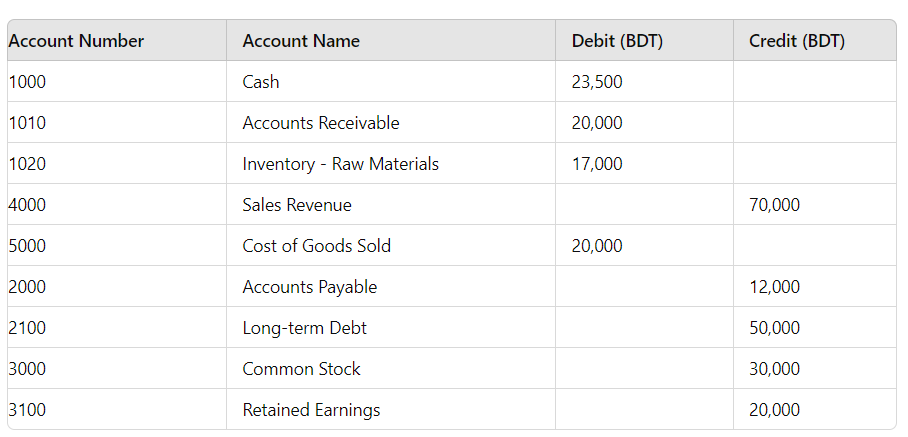

Chart of Accounts After Supplier Payment Entry

After recording the supplier payment, the chart of accounts reflects these changes:

| Account Number | Account Name | Debit (BDT) | Credit (BDT) |

|---|---|---|---|

| 1000 | Cash | 23,500 | |

| 1020 | Inventory - Raw Materials | 17,000 | |

| 2000 | Accounts Payable | 12,000 | |

| 2100 | Long-term Debt | 50,000 | |

| 3000 | Common Stock | 30,000 | |

| 3100 | Retained Earnings | 20,000 | |

| 6000 | Salaries and Wages Expense | 32,000 | |

| 2010 | Provident Fund Payable | 4,000 | |

| 2020 | Payroll Taxes Payable | 3,000 |

Explanation

- Accounts Payable (2000): Decreased by BDT 10,000, reflecting the reduction in the company's obligation to the supplier.

- Cash (1000): Decreased by BDT 10,000, reflecting the cash outflow to pay the supplier.

Effects on Financial Statements

Balance Sheet:

- Assets: Cash decreases due to the payment made to the supplier.

- Liabilities: Accounts Payable decreases, reflecting the reduction in the amount owed to suppliers.

Income Statement:

- There is no immediate impact on the income statement from this transaction, as it involves only balance sheet accounts.

Summary

Recording a supplier payment in an ERP system updates the company's financial records by decreasing both the cash account and the accounts payable account. This reflects the reduction in cash due to the payment made and the reduction in liabilities to suppliers. Ensuring accurate tracking of supplier payments is essential for maintaining a clear view of cash flow and outstanding obligations.

4. how payroll expenses, including Provident Fund (PF) and taxes, affect the chart of accounts

Let's illustrate how payroll expenses, including Provident Fund (PF) and taxes, affect the chart of accounts in an ERP system. We will consider a scenario where a company records payroll expenses for its employees, along with associated deductions and liabilities.

Scenario

A company processes payroll for its employees. The payroll includes gross salaries, deductions for Provident Fund (PF), and payroll taxes. Here's how the transaction affects the accounts:

Transaction Details:

- Date: 2023-07-31

- Gross Salaries: BDT 20,000

- Employee Provident Fund Deduction: BDT 2,000

- Employer Provident Fund Contribution: BDT 2,000

- Payroll Taxes: BDT 3,000

- Net Salaries Paid: BDT 15,000

Chart of Accounts Before Payroll Entry

Here’s a simplified version of the relevant chart of accounts before the payroll entry:

| Account Number | Account Name | Debit (BDT) | Credit (BDT) |

|---|---|---|---|

| 1000 | Cash | 48,500 | |

| 2000 | Accounts Payable | 22,000 | |

| 2100 | Long-term Debt | 50,000 | |

| 3000 | Common Stock | 30,000 | |

| 3100 | Retained Earnings | 20,000 | |

| 6000 | Salaries and Wages Expense | 10,000 | |

| 6010 | Payroll Taxes Expense | 0 | |

| 2010 | Provident Fund Payable | 0 | |

| 2020 | Payroll Taxes Payable | 0 |

Journal Entries for Payroll Expenses

When the payroll expenses are entered, the following journal entries are recorded:

Record the Salaries and Wages Expense:

- Debit: Salaries and Wages Expense for BDT 20,000

- Credit: Provident Fund Payable for BDT 2,000 (Employee Deduction)

- Credit: Payroll Taxes Payable for BDT 3,000

- Credit: Cash for BDT 15,000 (Net Salaries Paid)

Record the Employer's Provident Fund Contribution:

- Debit: Salaries and Wages Expense for BDT 2,000

- Credit: Provident Fund Payable for BDT 2,000

Chart of Accounts After Payroll Entry

After recording the payroll expenses, the chart of accounts reflects these changes:

| Account Number | Account Name | Debit (BDT) | Credit (BDT) |

|---|---|---|---|

| 1000 | Cash | 33,500 | |

| 2000 | Accounts Payable | 22,000 | |

| 2100 | Long-term Debt | 50,000 | |

| 3000 | Common Stock | 30,000 | |

| 3100 | Retained Earnings | 20,000 | |

| 6000 | Salaries and Wages Expense | 32,000 | |

| 6010 | Payroll Taxes Expense | 3,000 | |

| 2010 | Provident Fund Payable | 4,000 | |

| 2020 | Payroll Taxes Payable | 3,000 |

Explanation

- Salaries and Wages Expense (6000): Increased by BDT 22,000, reflecting the gross salaries and the employer's PF contribution.

- Payroll Taxes Expense (6010): Increased by BDT 3,000, reflecting the payroll taxes incurred.

- Provident Fund Payable (2010): Increased by BDT 4,000, reflecting both employee deductions and employer contributions.

- Payroll Taxes Payable (2020): Increased by BDT 3,000, reflecting the taxes withheld from employees.

- Cash (1000): Decreased by BDT 15,000, reflecting the net salaries paid to employees.

Effects on Financial Statements

Balance Sheet:

- Assets: Cash decreases due to net salary payments.

- Liabilities: Provident Fund Payable and Payroll Taxes Payable increase, reflecting the company's obligations for PF and taxes.

Income Statement:

- Expenses: Salaries and Wages Expense and Payroll Taxes Expense increase, reducing net income.

Summary

Recording payroll expenses in an ERP system involves accounting for gross salaries, deductions, and employer contributions. These transactions update the company's financial records, reflecting payroll-related liabilities and cash payments. This ensures accurate financial reporting and compliance with statutory requirements.

5. how an expense entry affects the chart of accounts

Let's demonstrate how an expense entry affects the chart of accounts in an ERP system. We will take an example where a company records an expense for utilities.

Scenario

A company incurs a utilities expense. Here’s the transaction and how it affects the accounts:

Transaction Details:

- Date: 2023-07-25

- Expense Type: Utilities

- Amount: BDT 1,500

- Payment Method: Cash

Chart of Accounts Before Expense Entry

Here’s a simplified version of the relevant chart of accounts before the expense is entered:

| Account Number | Account Name | Debit (BDT) | Credit (BDT) |

|---|---|---|---|

| 1000 | Cash | 50,000 | |

| 1020 | Inventory - Raw Materials | 17,000 | |

| 1100 | Property, Plant, and Equipment | 100,000 | |

| 1110 | Accumulated Depreciation | 15,000 | |

| 2000 | Accounts Payable | 22,000 | |

| 2100 | Long-term Debt | 50,000 | |

| 3000 | Common Stock | 30,000 | |

| 3100 | Retained Earnings | 20,000 | |

| 6020 | Utilities Expense | 1,500 |

Journal Entry for Utilities Expense

When the utilities expense is entered, the following journal entry is recorded:

- Record the Expense:

- Debit: Utilities Expense for BDT 1,500

- Credit: Cash for BDT 1,500

Chart of Accounts After Expense Entry

After recording the utilities expense, the chart of accounts reflects these changes:

| Account Number | Account Name | Debit (BDT) | Credit (BDT) |

|---|---|---|---|

| 1000 | Cash | 48,500 | |

| 1020 | Inventory - Raw Materials | 17,000 | |

| 1100 | Property, Plant, and Equipment | 100,000 | |

| 1110 | Accumulated Depreciation | 15,000 | |

| 2000 | Accounts Payable | 22,000 | |

| 2100 | Long-term Debt | 50,000 | |

| 3000 | Common Stock | 30,000 | |

| 3100 | Retained Earnings | 20,000 | |

| 6020 | Utilities Expense | 3,000 |

Explanation

- Utilities Expense (6020): Increased by BDT 1,500, reflecting the cost of utilities incurred.

- Cash (1000): Decreased by BDT 1,500, reflecting the payment made for utilities.

Effects on Financial Statements

Balance Sheet:

- Assets: Cash decreases, reflecting the payment made.

- Liabilities: No change, as this expense was paid in cash and did not involve any liability accounts.

Income Statement:

- Expenses: Utilities Expense increases, reducing net income.

Summary

Recording an expense in an ERP system updates both the expense account and the payment method account. In this example, the utilities expense is recorded in the expense account, and the cash account is credited to reflect the payment. This entry ensures accurate tracking of expenses and cash flow, supporting effective financial management and accurate financial reporting.

6. how a purchase invoice entry affects the chart of accounts

Let's walk through an example of how a purchase invoice entry affects the chart of accounts in an ERP system. This example will show how each account is impacted by a purchase transaction.

Scenario

A company purchases raw materials from a supplier on credit. Here’s the transaction and how it affects the accounts:

Transaction Details:

- Date: 2023-07-20

- Supplier: XYZ Corp

- Purchase Invoice Amount: BDT 12,000

- Description: Purchase of raw materials

Chart of Accounts Before Purchase Invoice Entry

Here's a simplified version of the relevant chart of accounts before the purchase invoice is entered:

| Account Number | Account Name | Debit (BDT) | Credit (BDT) |

|---|---|---|---|

| 1000 | Cash | 50,000 | |

| 1020 | Inventory - Raw Materials | 5,000 | |

| 1100 | Property, Plant, and Equipment | 100,000 | |

| 1110 | Accumulated Depreciation | 15,000 | |

| 2000 | Accounts Payable | 10,000 | |

| 2100 | Long-term Debt | 50,000 | |

| 3000 | Common Stock | 30,000 | |

| 3100 | Retained Earnings | 20,000 |

Journal Entry for Purchase Invoice

When the purchase invoice is entered, the following journal entry is recorded:

- Record the Purchase:

- Debit: Inventory - Raw Materials for BDT 12,000

- Credit: Accounts Payable for BDT 12,000

Chart of Accounts After Purchase Invoice Entry

After recording the purchase invoice, the chart of accounts reflects these changes:

| Account Number | Account Name | Debit (BDT) | Credit (BDT) |

|---|---|---|---|

| 1000 | Cash | 50,000 | |

| 1020 | Inventory - Raw Materials | 17,000 | |

| 1100 | Property, Plant, and Equipment | 100,000 | |

| 1110 | Accumulated Depreciation | 15,000 | |

| 2000 | Accounts Payable | 22,000 | |

| 2100 | Long-term Debt | 50,000 | |

| 3000 | Common Stock | 30,000 | |

| 3100 | Retained Earnings | 20,000 |

Explanation

- Inventory - Raw Materials (1020): Increased by BDT 12,000, reflecting the addition of raw materials purchased.

- Accounts Payable (2000): Increased by BDT 12,000, reflecting the liability to the supplier for the purchase.

Effects on Financial Statements

Balance Sheet:

- Assets: Inventory increases, reflecting more raw materials on hand.

- Liabilities: Accounts Payable increases, reflecting the amount owed to suppliers.

Income Statement:

- There is no immediate impact on the income statement from this transaction, as it involves only balance sheet accounts. The impact on the income statement occurs when the raw materials are used in production and recorded as Cost of Goods Sold.

Summary

Recording a purchase invoice in an ERP system updates both asset and liability accounts. The inventory account increases to reflect the addition of raw materials, while accounts payable increases to reflect the company's obligation to pay the supplier. This entry ensures that financial records accurately track the company's resources and obligations, supporting effective financial management.

Thanks.

Great topic! Understanding how entries like sales, purchases, returns, and expenses impact the chart of accounts in an ERP system is key to accurate financial records and better decision-making. Looking forward to learning more about this!~~roofers knocking on doors

ReplyDelete