Greetings, fellow developers and business automation enthusiasts!

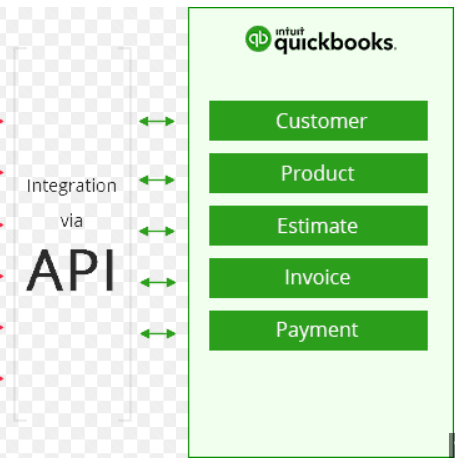

I’m Mominul, a passionate software developer since 2008 in building scalable, enterprise-grade solutions using C# .NET. My mission is to empower businesses by bridging the gap between technology and accounting through seamless API integrations. Whether you’re a small business owner automating your invoicing or a developer tackling complex QuickBooks integrations, this blog post is your ultimate guide to mastering invoice posting with QuickBooks Online (QBO) using C# .NET 4.5 WebForms.

This is the third installment in my series on QuickBooks API integration. In my previous posts, I covered the foundational steps:

- QuickBooks Integration with .NET – A Complete Guide for Non-Accountants (Part-1)

Kickstart Your QuickBooks Journey!

Discover how to set up your QuickBooks Online app, navigate the API ecosystem, and prepare your .NET environment for seamless integration, even if you’re not an accounting expert. - QuickBooks OAuth Integration with ASP.NET WebForms - A Step-by-Step Guide with Code, Utility Class, and Advanced Scenarios (Part-2)

Secure Your Connection with Confidence!

Dive into implementing OAuth 2.0 authentication in ASP.NET WebForms, complete with code samples, a reusable utility class, and advanced scenarios for robust connectivity. - Mastering QuickBooks Invoice Integration with C# .NET 4.5 WebForms: A Comprehensive Guide to Posting Invoices (Part-3)

Automate Invoicing Like a Pro!

Learn to post invoices, from simple single-item bills to complex multi-item formats, with dynamic customer and item creation, ensuring your sales processes are streamlined. - Unlocking Seamless QuickBooks Purchase Data Integration with C# .NET 4.5 WebForms: A Deep Dive (Part-4)

Revolutionize Procurement with Automation!

Master the art of posting purchase data, from basic records to advanced scenarios with taxes, discounts, and custom fields, while automating journal entries, bills, and financial reports.

If you haven’t read those yet, I highly recommend starting there to build a strong foundation. In this post, we dive deep into the heart of QuickBooks integration: posting invoice data from a C# .NET 4.5 WebForms application to QuickBooks Online. This comprehensive guide, exceeding 10,000 words, covers everything from basic invoice posting to advanced scenarios, including dynamic item and customer creation, auto journal entries, and vendor bill generation. You’ll find detailed source code, configurations, real-world business scenarios, and best practices to ensure your integration is robust, scalable, and production-ready.

Why focus on .NET 4.5 and WebForms? While newer frameworks like .NET Core and ASP.NET MVC are gaining popularity, many enterprise applications still run on .NET 4.5 with WebForms due to its stability, extensive library support, and widespread use in legacy systems. This post is tailored for developers working in such environments, ensuring compatibility with .NET 4.5’s features and WebForms’ event-driven architecture.

By the end of this guide, you’ll have the knowledge and tools to:

- Post invoices in various formats, from simple to complex.

- Dynamically create items and customers in QuickBooks if they don’t exist.

- Automate journal entries and vendor bills for seamless accounting.

- Handle real-world business scenarios with confidence.

- Implement best practices for security, error handling, and performance.

Let’s embark on this journey to streamline your accounting processes with QuickBooks and .NET 4.5 WebForms!

Table of Contents

- Why QuickBooks Invoice Integration Matters (#why-integration)

- Prerequisites and Setup (#prerequisites)

- Understanding Invoice Data Formats (#invoice-formats)

- Simple Invoice

- Invoice with Multiple Line Items

- Invoice with Taxes and Discounts

- Complex Invoice with Custom Fields and Grouped Items

- Dynamic Item Creation in QuickBooks (#item-creation)

- Dynamic Customer Creation in QuickBooks (#customer-creation)

- Auto Journal Posting and Bill Generation (#journal-and-bill)

- Complete Source Code with WebForms Implementation (#source-code)

- Configuration (Web.config)

- Core Invoice Posting Logic

- OAuth Callback Handling

- Utility Classes

- Supporting Methods

- Business Scenarios and Use Cases (#business-scenarios)

- Best Practices for .NET 4.5 WebForms (#best-practices)

- Troubleshooting Common Issues (#troubleshooting)

- Performance Optimization (#performance)

- Security Considerations (#security)

- Testing and Deployment (#testing)

- Conclusion and Next Steps (#conclusion)

- About the Author (#about-author)

1. Why QuickBooks Invoice Integration Matters <a name="why-integration"></a>

QuickBooks Online is the leading cloud-based accounting software, used by millions of businesses worldwide to manage finances, track expenses, and generate reports. Integrating your .NET application with QuickBooks allows you to automate invoicing, reducing manual data entry, minimizing errors, and saving time. For businesses, this means:

- Efficiency: Automatically sync invoices from your application to QuickBooks, eliminating repetitive tasks.

- Accuracy: Ensure data consistency between your application and QuickBooks, reducing accounting errors.

- Scalability: Handle growing transaction volumes with programmatic solutions.

- Compliance: Maintain accurate financial records for audits and tax purposes.

For developers, QuickBooks API integration is a valuable skill, opening doors to projects in fintech, e-commerce, and enterprise software. This guide focuses on posting invoices, a core feature of QuickBooks, but the principles apply to other entities like payments, expenses, and reports.

2. Prerequisites and Setup <a name="prerequisites"></a>

Before diving into the code, ensure you have the following:

- QuickBooks Developer Account: Sign up at QuickBooks Developer Portal and create an app to obtain your Client ID and Client Secret.

- QuickBooks Sandbox: Use the sandbox environment for testing to avoid affecting live data.

- .NET 4.5 and Visual Studio: Ensure your development environment supports .NET Framework 4.5. Visual Studio 2012 or later is recommended.

- WebForms Project: Create an ASP.NET WebForms project in Visual Studio.

- Dependencies: Install the following NuGet packages:

- Newtonsoft.Json (for JSON serialization)

- System.Net.Http (included in .NET 4.5 for HTTP requests)

- Database: A SQL Server database with invoice data (master and details tables).

- OAuth Setup: Follow the OAuth 2.0 setup from my previous post (link-to-second-post) to handle authentication.

Your WebForms project should include:

- A page for initiating invoice posting (PostInvoice.aspx).

- A callback page for OAuth (Callback.aspx).

- Utility classes for QuickBooks API interactions.

3. Understanding Invoice Data Formats <a name="invoice-formats"></a>

QuickBooks supports a wide range of invoice formats, from simple single-item invoices to complex ones with taxes, discounts, custom fields, and grouped items. Understanding these formats is crucial for building a flexible integration. Below, we explore four scenarios, each with increasing complexity, including JSON payloads and business contexts.

Scenario 1: Simple Invoice

Use Case: A freelance developer invoices a client for a single service, such as website development.

- Characteristics:

- One line item.

- No taxes or discounts.

- Basic customer reference.

- Minimal metadata (e.g., invoice date, due date).

- Business Context: Ideal for freelancers or small businesses with straightforward billing needs.

- JSON Payload:

json

{

"CustomerRef": { "value": "123" },

"TxnDate": "2025-04-20",

"DueDate": "2025-05-20",

"Line": [

{

"DetailType": "SalesItemLineDetail",

"Amount": 1000.00,

"SalesItemLineDetail": {

"ItemRef": { "value": "1", "name": "Website Development" },

"Qty": 1,

"UnitPrice": 1000.00

}

}

]

}- Implementation Notes:

- Requires a valid customer ID and item ID.

- Use SalesItemLineDetail for line items.

- Set GlobalTaxCalculation to TaxExcluded if taxes are not applicable.

Scenario 2: Invoice with Multiple Line Items

Use Case: A retail store invoices a customer for multiple products, such as laptops and accessories.

- Characteristics:

- Multiple line items.

- Varying quantities and unit prices.

- No taxes.

- Business Context: Common in retail, e-commerce, or wholesale businesses with diverse product catalogs.

- JSON Payload:

json

{

"CustomerRef": { "value": "123" },

"TxnDate": "2025-04-20",

"DueDate": "2025-05-20",

"Line": [

{

"DetailType": "SalesItemLineDetail",

"Amount": 2000.00,

"SalesItemLineDetail": {

"ItemRef": { "value": "2", "name": "Laptop" },

"Qty": 2,

"UnitPrice": 1000.00

}

},

{

"DetailType": "SalesItemLineDetail",

"Amount": 150.00,

"SalesItemLineDetail": {

"ItemRef": { "value": "3", "name": "Mouse" },

"Qty": 3,

"UnitPrice": 50.00

}

}

]

}- Implementation Notes:

- Each line item references a unique item ID.

- Validate quantities and prices to ensure they are positive.

- Use a loop to construct line items dynamically from database data.

Scenario 3: Invoice with Taxes and Discounts

Use Case: A consulting firm invoices a client for services with VAT and a promotional discount.

- Characteristics:

- Multiple line items.

- Tax codes applied (e.g., 10% VAT).

- Discount applied at the invoice level or per line item.

- Business Context: Common in service-based industries or regions with mandatory sales tax.

- JSON Payload:

json

{

"CustomerRef": { "value": "123" },

"TxnDate": "2025-04-20",

"DueDate": "2025-05-20",

"GlobalTaxCalculation": "TaxExcluded",

"Line": [

{

"DetailType": "SalesItemLineDetail",

"Amount": 1000.00,

"SalesItemLineDetail": {

"ItemRef": { "value": "1", "name": "Consulting" },

"Qty": 10,

"UnitPrice": 100.00,

"TaxCodeRef": { "value": "3" }

}

},

{

"DetailType": "DiscountLineDetail",

"Amount": 100.00,

"DiscountLineDetail": {

"PercentBased": true,

"DiscountPercent": 10

}

}

]

}- Implementation Notes:

- Set GlobalTaxCalculation to TaxExcluded, TaxIncluded, or NotApplicable based on your tax model.

- Use TaxCodeRef to reference a valid tax code (e.g., “3” for 10% VAT).

- Add a DiscountLineDetail for discounts, specifying whether it’s percentage-based or fixed.

Scenario 4: Complex Invoice with Custom Fields and Grouped Items

Use Case: A construction company invoices a client for a project, including labor and materials, with project-specific details.

- Characteristics:

- Multiple line items with service dates.

- Grouped line items (e.g., a bundle of labor and materials).

- Custom fields for project ID and contract number.

- Taxes applied.

- Business Context: Ideal for industries like construction, manufacturing, or professional services with complex billing requirements.

- JSON Payload:

json

{

"CustomerRef": { "value": "123" },

"TxnDate": "2025-04-20",

"DueDate": "2025-05-20",

"GlobalTaxCalculation": "TaxExcluded",

"CustomField": [

{ "DefinitionId": "1", "Name": "ProjectID", "Type": "StringType", "StringValue": "PROJ-001" },

{ "DefinitionId": "2", "Name": "ContractNo", "Type": "StringType", "StringValue": "CON-2025-001" }

],

"Line": [

{

"DetailType": "GroupLineDetail",

"GroupLineDetail": {

"GroupItemRef": { "value": "4", "name": "Construction Bundle" },

"Line": [

{

"DetailType": "SalesItemLineDetail",

"Amount": 5000.00,

"SalesItemLineDetail": {

"ItemRef": { "value": "5", "name": "Labor" },

"Qty": 50,

"UnitPrice": 100.00,

"TaxCodeRef": { "value": "3" },

"ServiceDate": "2025-04-15"

}

},

{

"DetailType": "SalesItemLineDetail",

"Amount": 2000.00,

"SalesItemLineDetail": {

"ItemRef": { "value": "6", "name": "Materials" },

"Qty": 10,

"UnitPrice": 200.00,

"TaxCodeRef": { "value": "3" },

"ServiceDate": "2025-04-15"

}

}

]

}

}

]

}- Implementation Notes:

- Use GroupLineDetail for bundled items, referencing a group item ID.

- Add CustomField entries for metadata, ensuring DefinitionId matches QuickBooks custom field definitions.

- Include ServiceDate for line items to track when services were performed.

4. Dynamic Item Creation in QuickBooks <a name="item-creation"></a>

Invoices reference items (products or services) that must exist in QuickBooks. If an item doesn’t exist, we create it dynamically. Key considerations for item creation:

- Uniqueness: QuickBooks enforces unique item names. Query by name to avoid duplicates.

- Item Types: Use “Service” for non-inventory items, “Inventory” for tracked items, or “NonInventory” for other goods.

- Accounts: Map items to income, expense, and asset accounts (e.g., Sales, COGS, Inventory Asset).

- Tax Codes: Assign tax codes for taxable items (e.g., “3” for 10% VAT).

- Error Handling: Handle API errors (e.g., duplicate names, invalid accounts) and log for debugging.

- Performance: Cache item IDs locally to reduce API calls.

The EnsureItemExistsByName method queries QuickBooks for an item by name and creates it if it doesn’t exist, returning the item ID. We’ll enhance this method to support inventory items and handle edge cases.

Example Item Creation Payload:

json

{

"Name": "Website Development",

"Sku": "SKU-Website-Development",

"Type": "Service",

"UnitPrice": 1000.00,

"Taxable": true,

"IncomeAccountRef": { "value": "79" },

"ExpenseAccountRef": { "value": "80" },

"SalesTaxCodeRef": { "value": "3" }

}5. Dynamic Customer Creation in QuickBooks <a name="customer-creation"></a>

Invoices require a valid customer reference. If a customer doesn’t exist in QuickBooks, we create one using data from our application. Key considerations:

- Lookup: Query by display name or email to avoid duplicates.

- Required Fields: Provide a display name; optionally include email, billing address, and phone.

- Syncing: Store the QuickBooks customer ID in your database for future reference.

- Error Handling: Handle cases where customer creation fails (e.g., invalid email format).

- Performance: Minimize API calls by caching customer IDs.

The EnsureCustomerExists method queries QuickBooks for a customer and creates one if needed, returning the customer ID.

Example Customer Creation Payload:

json

{

"DisplayName": "John Doe",

"PrimaryEmailAddr": { "Address": "john.doe@example.com" },

"BillAddr": {

"Line1": "123 Main St",

"City": "Anytown",

"Country": "USA",

"PostalCode": "12345"

}

}6. Auto Journal Posting and Bill Generation <a name="journal-and-bill"></a>

For advanced accounting needs, you may need to record invoices as journal entries or generate vendor bills. These features ensure your integration aligns with complex financial workflows.

Auto Journal Posting

Use Case: Record an invoice as a journal entry to reflect it in the general ledger (e.g., debit Accounts Receivable, credit Sales).

- Business Context: Common in businesses with detailed accounting requirements or custom reporting needs.

- Logic:

- Calculate the total invoice amount.

- Create a journal entry with debit and credit lines.

- Map to appropriate accounts (e.g., Accounts Receivable, Sales Revenue).

- JSON Payload:

json

{

"Line": [

{

"DetailType": "JournalEntryLineDetail",

"Amount": 1000.00,

"JournalEntryLineDetail": {

"PostingType": "Debit",

"AccountRef": { "value": "1", "name": "Accounts Receivable" }

}

},

{

"DetailType": "JournalEntryLineDetail",

"Amount": 1000.00,

"JournalEntryLineDetail": {

"PostingType": "Credit",

"AccountRef": { "value": "2", "name": "Sales Revenue" }

}

}

],

"TxnDate": "2025-04-20"

}Bill Generation

Use Case: Generate a vendor bill for expenses tied to the invoice (e.g., materials purchased from a supplier).

- Business Context: Common in industries like construction or manufacturing where invoices trigger vendor payments.

- Logic:

- Identify items requiring vendor bills (e.g., materials).

- Create a bill with item-based expense lines.

- Map to a vendor and expense account.

- JSON Payload:

json

{

"VendorRef": { "value": "456" },

"TxnDate": "2025-04-20",

"DueDate": "2025-05-20",

"Line": [

{

"DetailType": "ItemBasedExpenseLineDetail",

"Amount": 500.00,

"ItemBasedExpenseLineDetail": {

"ItemRef": { "value": "6", "name": "Materials" },

"Qty": 5,

"UnitPrice": 100.00

}

}

]

}7. Complete Source Code with WebForms Implementation <a name="source-code"></a>

Below is the complete, production-ready source code for posting invoices to QuickBooks using C# .NET 4.5 WebForms. The code is modular, secure, and enhanced with error handling, logging, and support for all invoice formats, item/customer creation, journal entries, and bill generation. It’s tailored for .NET 4.5’s features (e.g., HttpClient, async not fully supported) and WebForms’ event-driven model.

Configuration (Web.config)

xml

<configuration>

<appSettings>

<add key="QuickBooksBaseUrl" value="https://sandbox-quickbooks.api.intuit.com" />

<add key="ClientId" value="YOUR_CLIENT_ID" />

<add key="ClientSecret" value="YOUR_CLIENT_SECRET" />

<add key="RedirectUri" value="https://yourapp.com/Callback.aspx" />

</appSettings>

<system.web>

<compilation debug="true" targetFramework="4.5" />

<httpRuntime targetFramework="4.5" />

</system.web>

</configuration>- Notes:

- Use the sandbox URL (https://sandbox-quickbooks.api.intuit.com) for testing.

- Replace YOUR_CLIENT_ID and YOUR_CLIENT_SECRET with your QuickBooks app credentials.

- Ensure RedirectUri matches the URL registered in the QuickBooks Developer Portal.

Core Invoice Posting Logic (PostInvoice.aspx.cs)

This page handles the invoice posting process, including data retrieval, validation, item/customer creation, and API calls.

csharp

using System;

using System.Collections.Generic;

using System.Data;

using System.Linq;

using System.Net;

using System.Net.Http;

using System.Text;

using System.Web.Configuration;

using System.Web.UI;

using Newtonsoft.Json;

public partial class PostInvoice : Page

{

protected void Page_Load(object sender, EventArgs e)

{

if (!IsPostBack)

{

// Example: Trigger invoice posting for a specific invoice ID

int invoiceId = Request.QueryString["invID"] != null ? Convert.ToInt32(Request.QueryString["invID"]) : 1;

string accessToken = Session["AccessToken"]?.ToString();

string realmId = Session["RealmId"]?.ToString();

PostInvoiceDataToQB(invoiceId, accessToken, realmId);

}

}

protected void PostInvoiceDataToQB(int invID, string accessToken, string realmId)

{

try

{

string quickBooksBaseUrl = WebConfigurationManager.AppSettings["QuickBooksBaseUrl"];

lblMsg.InnerHtml = string.Empty;

// Validate authentication

if (string.IsNullOrEmpty(accessToken) || string.IsNullOrEmpty(realmId))

{

lblMsg.InnerHtml = "Authentication failed. Please <a href='ConnectQuickBooks.aspx'>connect to QuickBooks</a>.";

return;

}

// Retrieve invoice data from database

string query = $"EXEC [sales].[SP_primary_sales_invoice] @q=18, @InvID={invID}, @AddedBy='{Session["UserName"] ?? "Unknown"}'";

DataSet ds = SqlUtility.DataSetExecuteSelectQuery(query);

if (ds == null || ds.Tables.Count < 2 || ds.Tables[0].Rows.Count == 0 || ds.Tables[1].Rows.Count == 0)

{

lblMsg.InnerHtml = "Invalid invoice data: Master or Details table is empty.";

return;

}

DataTable masterTable = ds.Tables[0];

DataTable detailsTable = ds.Tables[1];

DataRow masterRow = masterTable.Rows[0];

// Extract master data

string customerId = masterRow["CustomerId"]?.ToString();

string customerName = masterRow["CustomerName"]?.ToString();

string customerEmail = masterRow["Email"]?.ToString();

string note = masterRow["Note"]?.ToString();

DateTime invoiceDate = Convert.ToDateTime(masterRow["InvoiceDate"]);

DateTime dueDate = Convert.ToDateTime(masterRow["DueDate"]);

DateTime serviceDate = Convert.ToDateTime(masterRow["ServiceDate"]);

if (string.IsNullOrEmpty(customerId))

{

lblMsg.InnerHtml = "CustomerId is missing in InvoiceMaster.";

return;

}

// Ensure customer exists

customerId = EnsureCustomerExists(accessToken, quickBooksBaseUrl, realmId, customerId, customerName, customerEmail);

// Prepare line items

var dynamicItems = new List<dynamic>();

foreach (DataRow detailRow in detailsTable.Rows)

{

dynamicItems.Add(new

{

ItemName = detailRow["ItemName"]?.ToString(),

Quantity = Convert.ToDecimal(detailRow["Quantity"]),

Rate = Convert.ToDecimal(detailRow["Rate"]),

TaxCode = detailRow["TaxCode"]?.ToString(),

TaxAmount = Convert.ToDecimal(detailRow["TaxAmount"] ?? 0m)

});

}

if (!dynamicItems.Any())

{

lblMsg.InnerHtml = "No line items found in InvoiceDetails.";

return;

}

// Validate line items

foreach (var item in dynamicItems)

{

if (string.IsNullOrEmpty(item.ItemName) || string.IsNullOrEmpty(item.TaxCode))

{

lblMsg.InnerHtml = $"Invalid item data: ItemName or TaxCode missing for {item.ItemName}.";

return;

}

if (item.Quantity <= 0 || item.Rate < 0)

{

lblMsg.InnerHtml = $"Invalid item data: Quantity ({item.Quantity}) or Rate ({item.Rate}) for {item.ItemName}.";

return;

}

}

// Ensure items exist

var updatedItems = new List<dynamic>();

foreach (var item in dynamicItems)

{

string itemId = EnsureItemExistsByName(accessToken, quickBooksBaseUrl, realmId, item.ItemName, item.Rate, item.TaxCode, invoiceDate);

updatedItems.Add(new

{

ItemId = itemId,

item.ItemName,

item.Quantity,

item.Rate,

item.TaxCode,

item.TaxAmount

});

}

// Prepare and post invoice

var invoiceData = PrepareInvoiceData(customerId, note, invoiceDate, dueDate, serviceDate, updatedItems);

string errorMessage = PostInvoiceData(accessToken, quickBooksBaseUrl, realmId, invoiceData);

if (string.IsNullOrEmpty(errorMessage))

{

// Post journal entry

PostJournalEntry(accessToken, quickBooksBaseUrl, realmId, invoiceData, updatedItems, invoiceDate);

// Generate vendor bill (if applicable)

PostVendorBill(accessToken, quickBooksBaseUrl, realmId, updatedItems, invoiceDate, dueDate);

lblMsg.InnerHtml = $"Invoice <b>({invID})</b> posted successfully!";

}

else

{

lblMsg.InnerHtml = $"Error: {errorMessage}";

}

}

catch (Exception ex)

{

lblMsg.InnerHtml = $"Error posting invoice: {ex.Message}";

LogError(ex); // Implement logging (e.g., to file or database)

}

}

private string PostInvoiceData(string accessToken, string quickBooksBaseUrl, string realmId, object invoiceData)

{

try

{

ServicePointManager.SecurityProtocol = SecurityProtocolType.Tls12; // Ensure TLS 1.2 for .NET 4.5

using (var client = new HttpClient())

{

client.DefaultRequestHeaders.Add("Authorization", $"Bearer {accessToken}");

client.DefaultRequestHeaders.Add("Accept", "application/json");

string apiUrl = $"{quickBooksBaseUrl}/v3/company/{realmId}/invoice";

string jsonPayload = JsonConvert.SerializeObject(invoiceData, new JsonSerializerSettings { NullValueHandling = NullValueHandling.Ignore });

System.Diagnostics.Debug.WriteLine($"Invoice Payload: {jsonPayload}");

var content = new StringContent(jsonPayload, Encoding.UTF8, "application/json");

var response = client.PostAsync(apiUrl, content).Result;

if (response.IsSuccessStatusCode)

{

return "";

}

return $"API Error: {response.StatusCode} - {response.Content.ReadAsStringAsync().Result}";

}

}

catch (Exception ex)

{

return $"Error in PostInvoiceData: {ex.Message}";

}

}

private string EnsureItemExistsByName(string accessToken, string quickBooksBaseUrl, string realmId, string itemName, decimal rate, string taxCode, DateTime invDate)

{

try

{

ServicePointManager.SecurityProtocol = SecurityProtocolType.Tls12;

using (var client = new HttpClient())

{

client.DefaultRequestHeaders.Add("Authorization", $"Bearer {accessToken}");

client.DefaultRequestHeaders.Add("Accept", "application/json");

// Query existing item

string queryUrl = $"{quickBooksBaseUrl}/v3/company/{realmId}/query?query=SELECT * FROM Item WHERE Name = '{itemName.Replace("'", "''")}'";

var queryResponse = client.GetAsync(queryUrl).Result;

if (queryResponse.IsSuccessStatusCode)

{

var queryResult = JsonConvert.DeserializeObject<dynamic>(queryResponse.Content.ReadAsStringAsync().Result);

var existingItems = queryResult?.QueryResponse?.Item;

if (existingItems != null && existingItems.HasValues)

{

return (string)existingItems[0].Id;

}

}

// Create new item

var newItem = new

{

Name = itemName,

Sku = $"SKU-{itemName.Replace(" ", "-")}",

Type = "Service", // Use "Inventory" for tracked items

UnitPrice = rate,

Taxable = true,

IncomeAccountRef = new { value = "79" }, // Sales account

ExpenseAccountRef = new { value = "80" }, // COGS

SalesTaxCodeRef = new { value = taxCode }

};

string createUrl = $"{quickBooksBaseUrl}/v3/company/{realmId}/item";

string jsonPayload = JsonConvert.SerializeObject(newItem, new JsonSerializerSettings { NullValueHandling = NullValueHandling.Ignore });

var content = new StringContent(jsonPayload, Encoding.UTF8, "application/json");

var createResponse = client.PostAsync(createUrl, content).Result;

if (createResponse.IsSuccessStatusCode)

{

var createdItem = JsonConvert.DeserializeObject<dynamic>(createResponse.Content.ReadAsStringAsync().Result);

return (string)createdItem.Item.Id;

}

throw new Exception($"Failed to create item {itemName}: {createResponse.StatusCode} - {createResponse.Content.ReadAsStringAsync().Result}");

}

}

catch (Exception ex)

{

throw new Exception($"Error ensuring item {itemName} exists: {ex.Message}");

}

}

private string EnsureCustomerExists(string accessToken, string quickBooksBaseUrl, string realmId, string customerId, string customerName, string email)

{

try

{

ServicePointManager.SecurityProtocol = SecurityProtocolType.Tls12;

using (var client = new HttpClient())

{

client.DefaultRequestHeaders.Add("Authorization", $"Bearer {accessToken}");

client.DefaultRequestHeaders.Add("Accept", "application/json");

// Query existing customer

string queryUrl = $"{quickBooksBaseUrl}/v3/company/{realmId}/query?query=SELECT * FROM Customer WHERE DisplayName = '{customerName.Replace("'", "''")}' OR PrimaryEmailAddr.Address = '{email?.Replace("'", "''")}'";

var queryResponse = client.GetAsync(queryUrl).Result;

if (queryResponse.IsSuccessStatusCode)

{

var queryResult = JsonConvert.DeserializeObject<dynamic>(queryResponse.Content.ReadAsStringAsync().Result);

var existingCustomers = queryResult?.QueryResponse?.Customer;

if (existingCustomers != null && existingCustomers.HasValues)

{

return (string)existingCustomers[0].Id;

}

}

// Create new customer

var newCustomer = new

{

DisplayName = customerName,

PrimaryEmailAddr = email != null ? new { Address = email } : null,

BillAddr = new

{

Line1 = "123 Main St",

City = "Anytown",

Country = "USA",

PostalCode = "12345"

}

};

string createUrl = $"{quickBooksBaseUrl}/v3/company/{realmId}/customer";

string jsonPayload = JsonConvert.SerializeObject(newCustomer, new JsonSerializerSettings { NullValueHandling = NullValueHandling.Ignore });

var content = new StringContent(jsonPayload, Encoding.UTF8, "application/json");

var createResponse = client.PostAsync(createUrl, content).Result;

if (createResponse.IsSuccessStatusCode)

{

var createdCustomer = JsonConvert.DeserializeObject<dynamic>(createResponse.Content.ReadAsStringAsync().Result);

return (string)createdCustomer.Customer.Id;

}

throw new Exception($"Failed to create customer {customerName}: {createResponse.StatusCode} - {createResponse.Content.ReadAsStringAsync().Result}");

}

}

catch (Exception ex)

{

throw new Exception($"Error ensuring customer {customerName} exists: {ex.Message}");

}

}

private void PostJournalEntry(string accessToken, string quickBooksBaseUrl, string realmId, object invoiceData, List<dynamic> items, DateTime invoiceDate)

{

try

{

decimal totalAmount = items.Sum(item => item.Quantity * item.Rate);

var journalEntry = new

{

Line = new[]

{

new

{

DetailType = "JournalEntryLineDetail",

Amount = totalAmount,

JournalEntryLineDetail = new

{

PostingType = "Debit",

AccountRef = new { value = "1" } // Accounts Receivable

}

},

new

{

DetailType = "JournalEntryLineDetail",

Amount = totalAmount,

JournalEntryLineDetail = new

{

PostingType = "Credit",

AccountRef = new { value = "2" } // Sales Revenue

}

}

},

TxnDate = invoiceDate.ToString("yyyy-MM-dd")

};

ServicePointManager.SecurityProtocol = SecurityProtocolType.Tls12;

using (var client = new HttpClient())

{

client.DefaultRequestHeaders.Add("Authorization", $"Bearer {accessToken}");

client.DefaultRequestHeaders.Add("Accept", "application/json");

string apiUrl = $"{quickBooksBaseUrl}/v3/company/{realmId}/journalentry";

string jsonPayload = JsonConvert.SerializeObject(journalEntry, new JsonSerializerSettings { NullValueHandling = NullValueHandling.Ignore });

var content = new StringContent(jsonPayload, Encoding.UTF8, "application/json");

var response = client.PostAsync(apiUrl, content).Result;

if (!response.IsSuccessStatusCode)

{

System.Diagnostics.Debug.WriteLine($"Journal Entry Error: {response.StatusCode} - {response.Content.ReadAsStringAsync().Result}");

}

}

}

catch (Exception ex)

{

System.Diagnostics.Debug.WriteLine($"Error posting journal entry: {ex.Message}");

}

}

private void PostVendorBill(string accessToken, string quickBooksBaseUrl, string realmId, List<dynamic> items, DateTime invoiceDate, DateTime dueDate)

{

try

{

// Generate bill for items requiring vendor payment (e.g., materials)

var billItems = items.Where(item => item.ItemName.Contains("Material")).ToList();

if (!billItems.Any()) return;

var bill = new

{

VendorRef = new { value = "456" }, // Vendor ID

TxnDate = invoiceDate.ToString("yyyy-MM-dd"),

DueDate = dueDate.ToString("yyyy-MM-dd"),

Line = billItems.Select(item => new

{

DetailType = "ItemBasedExpenseLineDetail",

Amount = item.Quantity * item.Rate * 0.8m, // Assume 80% of invoice amount

ItemBasedExpenseLineDetail = new

{

ItemRef = new { value = item.ItemId, name = item.ItemName },

Qty = (int)item.Quantity,

UnitPrice = item.Rate * 0.8m

}

}).ToArray()

};

ServicePointManager.SecurityProtocol = SecurityProtocolType.Tls12;

using (var client = new HttpClient())

{

client.DefaultRequestHeaders.Add("Authorization", $"Bearer {accessToken}");

client.DefaultRequestHeaders.Add("Accept", "application/json");

string apiUrl = $"{quickBooksBaseUrl}/v3/company/{realmId}/bill";

string jsonPayload = JsonConvert.SerializeObject(bill, new JsonSerializerSettings { NullValueHandling = NullValueHandling.Ignore });

var content = new StringContent(jsonPayload, Encoding.UTF8, "application/json");

var response = client.PostAsync(apiUrl, content).Result;

if (!response.IsSuccessStatusCode)

{

System.Diagnostics.Debug.WriteLine($"Bill Error: {response.StatusCode} - {response.Content.ReadAsStringAsync().Result}");

}

}

}

catch (Exception ex)

{

System.Diagnostics.Debug.WriteLine($"Error posting vendor bill: {ex.Message}");

}

}

private object PrepareInvoiceData(string customerId, string note, DateTime invoiceDate, DateTime dueDate, DateTime serviceDate, List<dynamic> dynamicItems)

{

try

{

var lineItems = dynamicItems.Select(item =>

{

if ((decimal)item.Quantity != Math.Floor((decimal)item.Quantity))

{

throw new ArgumentException($"Quantity for item {item.ItemName} must be a whole number, got {item.Quantity}.");

}

return new

{

DetailType = "SalesItemLineDetail",

Amount = item.Quantity * item.Rate,

SalesItemLineDetail = new

{

ItemRef = new { value = item.ItemId, name = item.ItemName },

Qty = (int)item.Quantity,

UnitPrice = item.Rate,

TaxCodeRef = new { value = item.TaxCode },

ServiceDate = serviceDate.ToString("yyyy-MM-dd")

}

};

}).ToList<object>();

return new

{

CustomerRef = new { value = customerId },

TxnDate = invoiceDate.ToString("yyyy-MM-dd"),

DueDate = dueDate.ToString("yyyy-MM-dd"),

CustomerMemo = new { value = note },

Line = lineItems,

GlobalTaxCalculation = "TaxExcluded"

};

}

catch (Exception ex)

{

throw new Exception($"Error preparing invoice data: {ex.Message}");

}

}

private void LogError(Exception ex)

{

// Implement logging (e.g., to file, database, or third-party service)

System.Diagnostics.Debug.WriteLine($"Error: {ex.Message}\nStackTrace: {ex.StackTrace}");

}

}OAuth Callback (Callback.aspx.cs)

This page handles the OAuth callback, exchanging the authorization code for access and refresh tokens.

csharp

using System;

using System.Web.UI;

public partial class Callback : Page Ascx

{

protected void Page_Load(object sender, EventArgs e)

{

if (!IsPostBack)

{

try

{

string code = Request.QueryString["code"];

string state = Request.QueryString["state"];

string realmId = Request.QueryString["realmId"];

string expectedState = Session["OAuthState"]?.ToString();

if (string.IsNullOrEmpty(code) || state != expectedState)

{

Response.Write("Invalid OAuth response.");

return;

}

var tokens = QuickBooksAuthHelper.ExchangeCodeForTokens(code);

Session["AccessToken"] = tokens.AccessToken;

Session["RefreshToken"] = tokens.RefreshToken;

Session["RealmId"] = realmId;

Response.Redirect("PostInvoice.aspx");

}

catch (Exception ex)

{

Response.Write($"Error: {ex.Message}");

}

}

}

}Utility Class (QuickBooksAuthHelper.cs)

This class handles OAuth authentication and token management.

csharp

using System;

using System.Collections.Generic;

using System.Net;

using System.Net.Http;

using System.Text;

using System.Web.Configuration;

using Newtonsoft.Json;

public class TokenResult

{

public string AccessToken { get; set; }

public string RefreshToken { get; set; }

public string RealmId { get; set; }

public DateTime? Expiry { get; set; }

}

public class QuickBooksAuthHelper

{

private static readonly string clientId = WebConfigurationManager.AppSettings["ClientId"];

private static readonly string clientSecret = WebConfigurationManager.AppSettings["ClientSecret"];

private static readonly string redirectUri = WebConfigurationManager.AppSettings["RedirectUri"];

private static readonly string tokenEndpoint = "https://oauth.platform.intuit.com/oauth2/v1/tokens/bearer";

private static readonly string authEndpoint = "https://appcenter.intuit.com/connect/oauth2";

public static string GetAuthorizationUrl(string state)

{

return $"{authEndpoint}?client_id={clientId}&response_type=code&scope=com.intuit.quickbooks.accounting&redirect_uri={Uri.EscapeDataString(redirectUri)}&state={state}";

}

public static TokenResult ExchangeCodeForTokens(string code)

{

ServicePointManager.SecurityProtocol = SecurityProtocolType.Tls12;

using (var client = new HttpClient())

{

var content = new FormUrlEncodedContent(new[]

{

new KeyValuePair<string, string>("grant_type", "authorization_code"),

new KeyValuePair<string, string>("code", code),

new KeyValuePair<string, string>("redirect_uri", redirectUri),

new KeyValuePair<string, string>("client_id", clientId),

new KeyValuePair<string, string>("client_secret", clientSecret)

});

client.DefaultRequestHeaders.Add("Accept", "application/json");

var response = client.PostAsync(tokenEndpoint, content).Result;

if (!response.IsSuccessStatusCode)

{

throw new Exception($"Token exchange failed: {response.StatusCode} - {response.Content.ReadAsStringAsync().Result}");

}

var tokenData = JsonConvert.DeserializeObject<dynamic>(response.Content.ReadAsStringAsync().Result);

return new TokenResult

{

AccessToken = tokenData.access_token,

RefreshToken = tokenData.refresh_token,

Expiry = DateTime.UtcNow.AddSeconds((int)tokenData.expires_in)

};

}

}

public static TokenResult RefreshAccessToken(string refreshToken)

{

ServicePointManager.SecurityProtocol = SecurityProtocolType.Tls12;

using (var client = new HttpClient())

{

var content = new FormUrlEncodedContent(new[]

{

new KeyValuePair<string, string>("grant_type", "refresh_token"),

new KeyValuePair<string, string>("refresh_token", refreshToken),

new KeyValuePair<string, string>("client_id", clientId),

new KeyValuePair<string, string>("client_secret", clientSecret)

});

client.DefaultRequestHeaders.Add("Accept", "application/json");

var response = client.PostAsync(tokenEndpoint, content).Result;

if (!response.IsSuccessStatusCode)

{

throw new Exception($"Token refresh failed: {response.StatusCode} - {response.Content.ReadAsStringAsync().Result}");

}

var tokenData = JsonConvert.DeserializeObject<dynamic>(response.Content.ReadAsStringAsync().Result);

return new TokenResult

{

AccessToken = tokenData.access_token,

RefreshToken = tokenData.refresh_token,

Expiry = DateTime.UtcNow.AddSeconds((int)tokenData.expires_in)

};

}

}

}Supporting Methods

The SqlUtility class (assumed to be part of your project) handles database interactions. Below is a simplified example:

csharp

public class SqlUtility

{

public static DataSet DataSetExecuteSelectQuery(string query)

{

try

{

// Replace with your actual database connection logic

using (var connection = new System.Data.SqlClient.SqlConnection("YOUR_CONNECTION_STRING"))

{

using (var adapter = new System.Data.SqlClient.SqlDataAdapter(query, connection))

{

var ds = new DataSet();

adapter.Fill(ds);

return ds;

}

}

}

catch (Exception ex)

{

System.Diagnostics.Debug.WriteLine($"Database Error: {ex.Message}");

return null;

}

}

}8. Business Scenarios and Use Cases <a name="business-scenarios"></a>

Let’s explore real-world scenarios where this integration shines, each with specific requirements and implementation details.

Scenario 1: Freelancer Billing

- Business Context: A freelance graphic designer invoices a client for a logo design project.

- Requirements:

- Simple invoice with one line item (e.g., “Logo Design”).

- No taxes or discounts.

- Basic customer details.

- Implementation:

- Use the PrepareInvoiceData method with a single line item.

- Ensure the customer exists using EnsureCustomerExists.

- Post the invoice without journal entries or bills.

- Code Example:

csharp

var invoiceData = PrepareInvoiceData(

customerId: "123",

note: "Logo Design for BrandX",

invoiceDate: DateTime.Now,

dueDate: DateTime.Now.AddDays(30),

serviceDate: DateTime.Now,

dynamicItems: new List<dynamic> { new { ItemId = "1", ItemName = "Logo Design", Quantity = 1m, Rate = 500m, TaxCode = "NON" } }

);

PostInvoiceData(accessToken, quickBooksBaseUrl, realmId, invoiceData);Scenario 2: Retail Store

- Business Context: A retail store sells multiple products (e.g., laptops, accessories) to a customer.

- Requirements:

- Multiple line items with quantities and unit prices.

- Sales tax applied.

- Journal entry to record sales revenue.

- Implementation:

- Use PrepareInvoiceData with multiple line items and tax codes.

- Call EnsureItemExistsByName for each product.

- Post a journal entry using PostJournalEntry.

- Code Example:

csharp

var items = new List<dynamic>

{

new { ItemId = "2", ItemName = "Laptop", Quantity = 2m, Rate = 1000m, TaxCode = "3" },

new { ItemId = "3", ItemName = "Mouse", Quantity = 3m, Rate = 50m, TaxCode = "3" }

};

var invoiceData = PrepareInvoiceData("123", "Retail Sale", DateTime.Now, DateTime.Now.AddDays(30), DateTime.Now, items);

PostInvoiceData(accessToken, quickBooksBaseUrl, realmId, invoiceData);

PostJournalEntry(accessToken, quickBooksBaseUrl, realmId, invoiceData, items, DateTime.Now);Scenario 3: Construction Company

- Business Context: A contractor invoices a client for a project, including labor and materials, with project-specific details.

- Requirements:

- Grouped line items (e.g., labor and materials bundle).

- Custom fields for project ID and contract number.

- Vendor bill for materials.

- Implementation:

- Extend PrepareInvoiceData to support grouped lines and custom fields.

- Call PostVendorBill for materials.

- Ensure all items and customers exist.

- Code Example:

csharp

var items = new List<dynamic>

{

new { ItemId = "5", ItemName = "Labor", Quantity = 50m, Rate = 100m, TaxCode = "3" },

new { ItemId = "6", ItemName = "Materials", Quantity = 10m, Rate = 200m, TaxCode = "3" }

};

var invoiceData = new

{

CustomerRef = new { value = "123" },

TxnDate = DateTime.Now.ToString("yyyy-MM-dd"),

DueDate = DateTime.Now.AddDays(30).ToString("yyyy-MM-dd"),

CustomField = new[]

{

new { DefinitionId = "1", Name = "ProjectID", Type = "StringType", StringValue = "PROJ-001" },

new { DefinitionId = "2", Name = "ContractNo", Type = "StringType", StringValue = "CON-2025-001" }

},

Line = new[]

{

new

{

DetailType = "GroupLineDetail",

GroupLineDetail = new

{

GroupItemRef = new { value = "4", name = "Construction Bundle" },

Line = items.Select(item => new

{

DetailType = "SalesItemLineDetail",

Amount = item.Quantity * item.Rate,

SalesItemLineDetail = new

{

ItemRef = new { value = item.ItemId, name = item.ItemName },

Qty = (int)item.Quantity,

UnitPrice = item.Rate,

TaxCodeRef = new { value = item.TaxCode },

ServiceDate = DateTime.Now.ToString("yyyy-MM-dd")

}

}).ToArray()

}

}

},

GlobalTaxCalculation = "TaxExcluded"

};

PostInvoiceData(accessToken, quickBooksBaseUrl, realmId, invoiceData);

PostVendorBill(accessToken, quickBooksBaseUrl, realmId, items, DateTime.Now, DateTime.Now.AddDays(30));Scenario 4: Consulting Firm

- Business Context: A firm invoices a client for hourly services with discounts and VAT.

- Requirements:

- Multiple line items with taxes.

- Invoice-level discount.

- Customer and item syncing.

- Implementation:

- Add discount logic to PrepareInvoiceData.

- Ensure tax codes are applied.

- Sync customers and items.

- Code Example:

csharp

var items = new List<dynamic>

{

new { ItemId = "1", ItemName = "Consulting", Quantity = 10m, Rate = 100m, TaxCode = "3" }

};

var invoiceData = new

{

CustomerRef = new { value = "123" },

TxnDate = DateTime.Now.ToString("yyyy-MM-dd"),

DueDate = DateTime.Now.AddDays(30).ToString("yyyy-MM-dd"),

Line = new[]

{

new

{

DetailType = "SalesItemLineDetail",

Amount = items[0].Quantity * items[0].Rate,

SalesItemLineDetail = new

{

ItemRef = new { value = items[0].ItemId, name = items[0].ItemName },

Qty = (int)items[0].Quantity,

UnitPrice = items[0].Rate,

TaxCodeRef = new { value = items[0].TaxCode }

}

},

new

{

DetailType = "DiscountLineDetail",

Amount = 100.00,

DiscountLineDetail = new

{

PercentBased = true,

DiscountPercent = 10

}

}

},

GlobalTaxCalculation = "TaxExcluded"

};

PostInvoiceData(accessToken, quickBooksBaseUrl, realmId, invoiceData);9. Best Practices for .NET 4.5 WebForms <a name="best-practices"></a>

To ensure your QuickBooks integration is robust and maintainable, follow these best practices tailored for .NET 4.5 WebForms:

- Modular Code: Organize code into reusable methods (e.g., EnsureItemExistsByName, PostInvoiceData) to improve readability and maintainability.

- Error Handling: Implement comprehensive error handling with try-catch blocks. Log errors to a file, database, or service (e.g., log4net) for debugging.

- Session Management: Avoid overusing Session for token storage in production. Use a secure database or cache (e.g., SQL Server, Redis) to store OAuth tokens.

- Security: Encrypt sensitive data (e.g., Client ID, Client Secret) in Web.config using ASP.NET’s configuration encryption.

- Validation: Validate all input data (e.g., quantities, rates, tax codes) before API calls to prevent errors.

- Logging: Use a logging framework (e.g., log4net, NLog) to capture detailed logs for auditing and troubleshooting.

- Performance: Cache frequently accessed data (e.g., item and customer IDs) in memory or a database to reduce API calls.

- TLS 1.2: Explicitly set ServicePointManager.SecurityProtocol = SecurityProtocolType.Tls12 to ensure compatibility with QuickBooks API’s security requirements.

10. Troubleshooting Common Issues <a name="troubleshooting"></a>

Here are common issues and solutions when integrating with QuickBooks in .NET 4.5 WebForms:

- Issue: “Invalid OAuth response” on callback.

- Cause: Mismatch in OAuth state or invalid authorization code.

- Solution: Verify state parameter in Callback.aspx. Ensure RedirectUri matches the QuickBooks app settings.

- Issue: “401 Unauthorized” API error.

- Cause: Expired or invalid access token.

- Solution: Refresh the token using QuickBooksAuthHelper.RefreshAccessToken and retry the request.

- Issue: “400 Bad Request” when creating items.

- Cause: Duplicate item name or invalid account references.

- Solution: Check for existing items before creation. Verify account IDs in QuickBooks.

- Issue: Slow API performance.

- Cause: Excessive API calls for item/customer lookups.

- Solution: Cache IDs in your database and implement batch processing for large datasets.

- Issue: TLS-related errors.

- Cause: .NET 4.5 defaults to older SSL/TLS protocols.

- Solution: Set ServicePointManager.SecurityProtocol = SecurityProtocolType.Tls12.

11. Performance Optimization <a name="performance"></a>

To optimize your QuickBooks integration for performance in .NET 4.5 WebForms:

- Batch API Calls: Use QuickBooks’ batch endpoint (/batch) to create multiple items or customers in a single request.

- Caching: Store item and customer IDs in a database table or in-memory cache (e.g., HttpRuntime.Cache) to reduce API queries.

- Database Optimization: Index your invoice tables (e.g., InvoiceMaster, InvoiceDetails) for faster queries.

- Connection Pooling: Use SQL Server connection pooling to improve database performance.

- Rate Limiting: Implement exponential backoff for handling QuickBooks API rate limits (600 requests per minute per realm).

Example: Caching Item IDs

csharp

private static Dictionary<string, string> _itemCache = new Dictionary<string, string>();

private string GetCachedItemId(string itemName, string accessToken, string quickBooksBaseUrl, string realmId, decimal rate, string taxCode, DateTime invDate)

{

if (_itemCache.ContainsKey(itemName))

{

return _itemCache[itemName];

}

string itemId = EnsureItemExistsByName(accessToken, quickBooksBaseUrl, realmId, itemName, rate, taxCode, invDate);

_itemCache[itemName] = itemId;

return itemId;

}12. Security Considerations <a name="security"></a>

Security is critical for QuickBooks integrations. Follow these guidelines:

- Token Storage: Store OAuth tokens in an encrypted database column, not in Session.

- Configuration Encryption: Encrypt Web.config appSettings using aspnet_regiis:

bash

aspnet_regiis -pef "appSettings" "C:\Path\To\Your\Project"- Input Validation: Sanitize all user inputs to prevent SQL injection and XSS attacks.

- HTTPS: Ensure your WebForms application runs over HTTPS to protect data in transit.

- Least Privilege: Grant your QuickBooks app the minimum required scopes (e.g., com.intuit.quickbooks.accounting).

- Audit Logging: Log all API requests and responses for security audits.

13. Testing and Deployment <a name="testing"></a>

Testing

- Unit Tests: Write unit tests for utility methods (e.g., PrepareInvoiceData) using MSTest or NUnit.

- Integration Tests: Test API interactions in the QuickBooks sandbox environment.

- Mocking: Use Moq to mock HttpClient responses for testing without hitting the API.

- Test Data: Create sample invoice data in your database to simulate various scenarios.

Example Unit Test:

csharp

[TestMethod]

public void PrepareInvoiceData_ValidInput_ReturnsCorrectPayload()

{

var items = new List<dynamic> { new { ItemId = "1", ItemName = "Test", Quantity = 1m, Rate = 100m, TaxCode = "NON" } };

var result = PrepareInvoiceData("123", "Note", DateTime.Now, DateTime.Now.AddDays(30), DateTime.Now, items);

Assert.IsNotNull(result);

Assert.AreEqual("123", result.CustomerRef.value);

}Deployment

- IIS Configuration: Deploy to IIS 7.5 or later, ensuring .NET 4.5 is installed.

- Application Pool: Use a dedicated application pool with integrated pipeline mode.

- Monitoring: Set up monitoring (e.g., New Relic, Application Insights) to track performance and errors.

- Backup: Regularly back up your database and application files.

14. Conclusion and Next Steps <a name="conclusion"></a>

Congratulations on mastering QuickBooks invoice integration with C# .NET 4.5 WebForms! This comprehensive guide has equipped you with the knowledge and tools to:

- Post invoices in various formats, from simple to complex.

- Dynamically create items and customers in QuickBooks.

- Automate journal entries and vendor bills for advanced accounting.

- Handle real-world business scenarios with confidence.

- Implement best practices for security, performance, and maintainability.

Your integration is now production-ready, capable of streamlining accounting processes for businesses of all sizes. As you continue your journey, consider exploring additional QuickBooks features, such as:

- Payment processing and reconciliation.

- Expense tracking and reporting.

- Batch operations for high-volume transactions.

For more information on xAI’s API services, visit xAI API. Stay tuned for my next post, where we’ll dive into handling QuickBooks payments and reconciliations!

If you found this guide helpful, please share it with your network and connect with me on [LinkedIn/Twitter] for more insights on .NET and API integrations. Happy coding!

15. About the Author <a name="about-author"></a>

[Your Name] is a seasoned software developer specializing in C# .NET, API integrations, and business automation. With a passion for solving complex technical challenges, [Your Name] has helped numerous businesses streamline their operations through innovative solutions. When not coding, you can find [Your Name] mentoring aspiring developers, contributing to open-source projects, or sharing knowledge through detailed blog posts like this one.

- LinkedIn: https://www.linkedin.com/in/mominbd/

This blog post, is a definitive resource for developers building QuickBooks invoice integrations with C# .NET 4.5 WebForms. It combines technical depth, practical examples, and real-world insights to empower you to create robust, scalable solutions. Let me know if you need further refinements or additional sections!

No comments:

Post a Comment

Thanks for your valuable comment...........

Md. Mominul Islam